How will the new tariffs affect home values and real estate in central Texas?

First, I want to say this is not a political email. The reason I wanted to address it is because since last week everyone is talking about the tarrifs. I am sure you have had the same experience.

I have been talking to people who are in the market now and plan to be in the near future and the same question comes up. How are the tarrifs going to affect the Austin real estate market? Well the truth is we don't know, but we do know how the housing market reacts to certain economic conditions. I intend to share that with you in this email. The are many unknowns and a high level of uncertainity on if the tariffs will be revoked or stay in place, but there are a few general trends worth discussing.

1) I am NOT saying there is going to be a recession but there is a lot of talk about it.

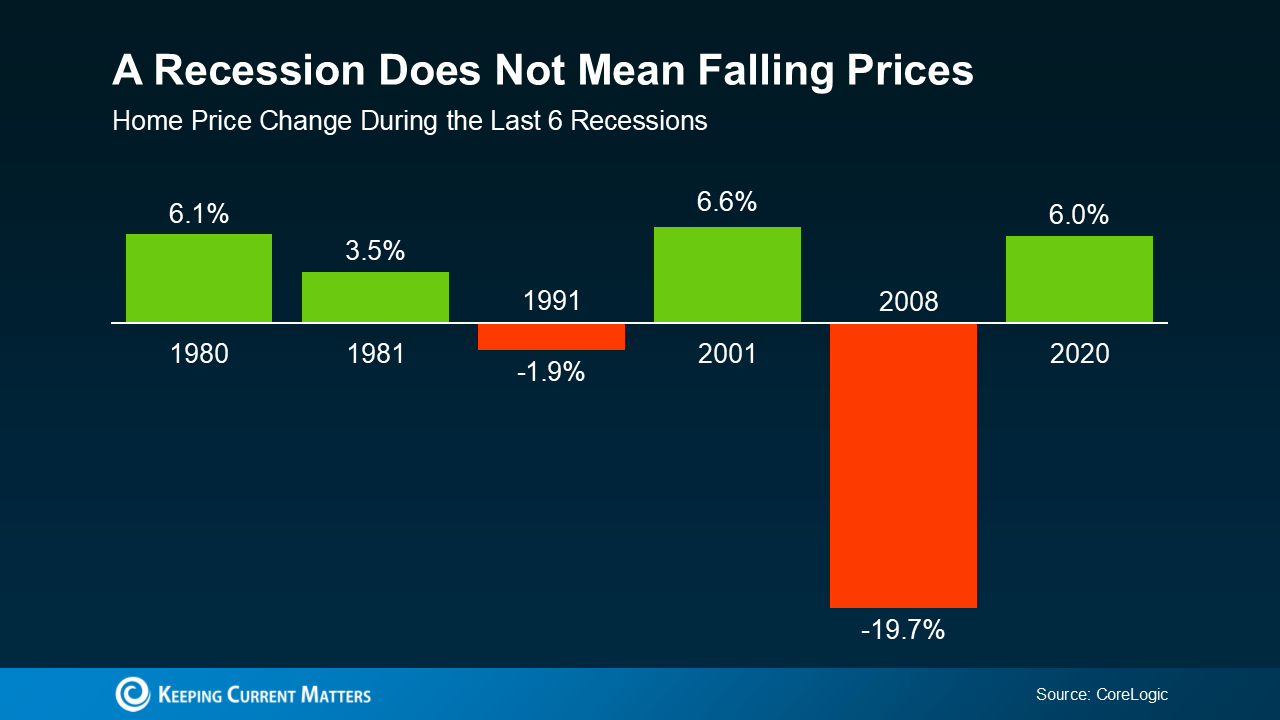

If there is one, home values are generally stable in recessions. The major US stock indices have seen sharp reductions in the few days, but in challenging economic times such as recessions home values are more stable than other financial assets. In fact, in four out of the last six recessions in the U.S. witnessed home price appreciation. This highlights the complex interplay of various factors influencing housing market trends.

2) Home values general increase faster than inflation.

There is increasing concern that the tariffs will spark renewed inflation. Real estate is generally considered a safe place to invest in an inflationary environment, as home prices are normally rise faster than the rate of inflation.

For more information

3) Cost of new homes and repairs anticipated to increase.

There is an expectation of increased costs for repairs (for both imported materials and labor) for resale homes and increased costs for new construction. For example a recent survey of homebuilders found that they expect an average cost increase of $9,200 per home due to the recent tariffs. This may create upward pressure on price, which may reduce demand.

4) Mortgage rates will be volatile for a while.

Last Friday I got a message from one of the lenders I work with with this headline: "Mortgage Rates DROP to 6-Month Lows!" Then yesterday I got this article stating intereste rates are surging. Stay tuned, higher interest rates have been one of the main reasons that the real estate market has cooled since 2022. I'm stating the obvious, but If rates improve that will spur on more activity in our market.

5) Rental investment property provides diversification and stability.

For investors seeking to diversify rental investment property is an attractive option. Rental properties tend to be both a hedge against inflation and in recessionary environments. Now may be a great time to buy your first rental property or add to your portfolio.

For more information

I just wanted to review the situation and explain what I have experienced in my 25 years in real estate and going through every kind of market since. As you may know, my background is in Accounting and Ecomics so monitoring the markets is always of interest to mel

Give me a call or drop me an email if you want to discuss these trends further, or if I can assist you with any of your real estate needs.

Judith Bundschuh, C.P.A.

2013 Realtor of the Year 2011 Chairman of the Austin Board of Realtors